Bad Debts Recovered Journal Entry

Help build up the trust of a new customer. We would like to show you a description here but the site wont allow us.

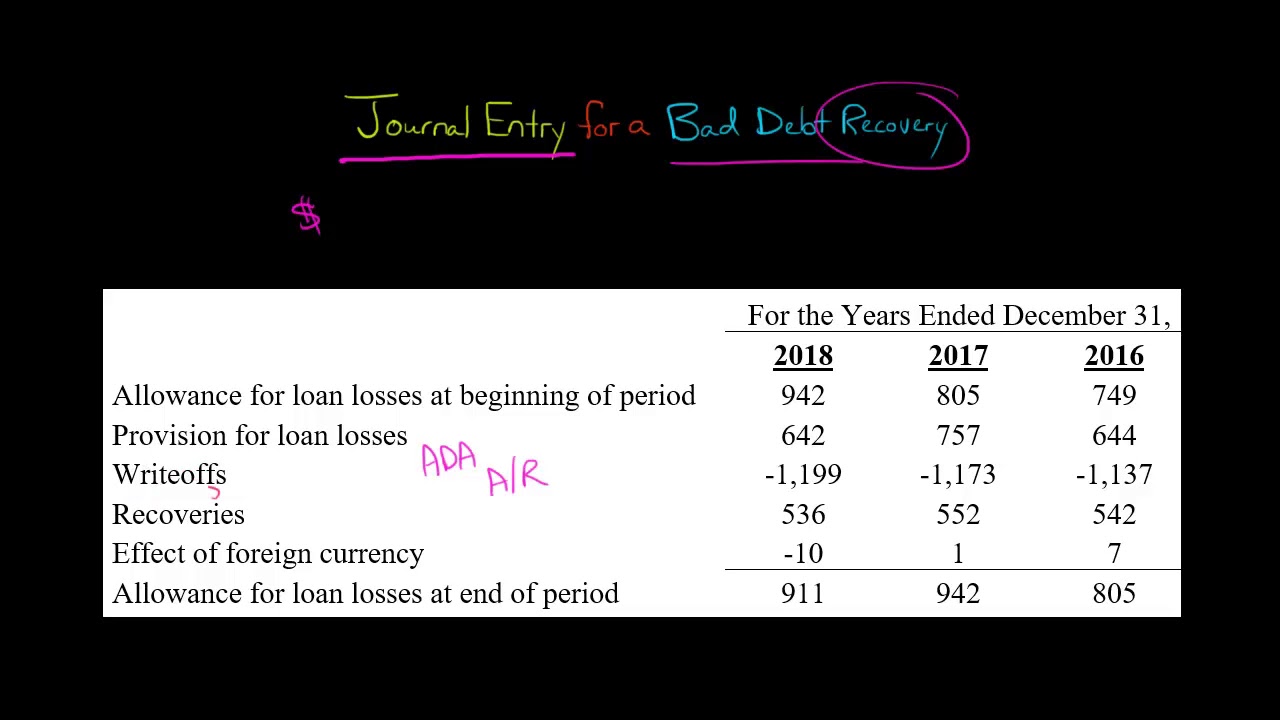

Journal Entry For A Bad Debt Recovery Youtube

The journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the Sales account.

. Read more is 5000. Bad debt recovery is the payment. Enter the email address you signed up with and well email you a reset link.

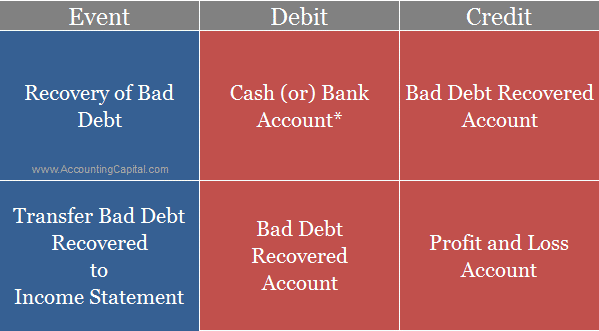

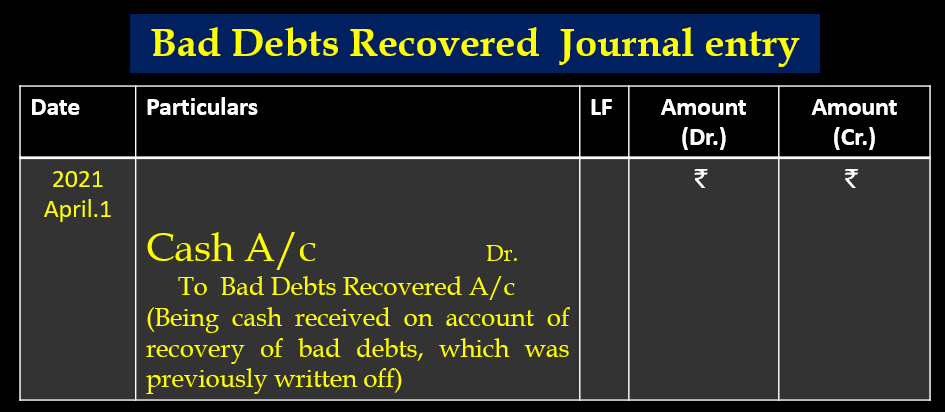

Irrecoverable debts recovered Sometimes a debt written off in one year is actually paid in the next year a debit to cash and a credit to irrecoverable debts recovered. Bad debts are the organisations debts that are either irrecoverable or uncollectable. This article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from him.

Reasons for Bad Debt. Be part of the credit control strategy of a business. Partially or fully irrecoverable debts are called bad debtsAccounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors NameBad debt is a loss for the business and it is transferred to the income statement to adjust against the current periods incomeBad debts recovered.

In this situation result. A account receivable that has previously been written off may subsequently be recovered in full or in part. The closing journal entry for bad debts recovered would be as follows.

In business terms bad debts are a loss to the company and hence should be limited. Overview of Accounts Receivable Journal. It is the amount that the company collected or recovered from the account receivable that claim as uncollectable and was considered based on the company policies as bad debt.

The entry to record this recover debt is debit cash and credit other income. For example lets say that Zico Company allows for a 10 bad debts allowance for the first 30 days and a 12 bad debts allowance within the next 31 to 60 days period. Bad Debts Recovered AC Debit To Profit and Loss AC Credit Transferring bad debts recovered to the income statement Related Topic Journal Entry for Credit Sales and Cash Sales Treatment of Bad Debts Recovered in the Accounting Books Bad Debts Recovered Shown Inside a Financial.

Enter the email address you signed up with and well email you a reset link. Example 1 As on 01012012 Provision for Bad Debts Bad Debts Bad Debts can be described as unforeseen loss incurred by a business organization on account of non-fulfillment of agreed terms and conditions on account of sale of goods or services or repayment of any loan or other obligation. It is transferred to the loss side of the PL account and is also reflected in the Trial Balance sheet as an entry recoverable from its profits.

When bad debts are recovered the bad debts recovery account is other income in the income statement. In the accounting world Journal refers to a book wherein transactions are logged for the very first time and that is why it is also called as Book of Original EntryIn this financial accounting topic in the book all the regular business transactions are entered sequentially ie. Below are the examples of provisions for a bad debt journal entry.

Reduce risk to business of irrecoverable debts by limiting the amount sold on credit. Once you have established a business in Manager the most important task is structuring your accounts to match your form of organization method of operation legal reporting requirements and management information needs. In this exam you must be prepared to see both the terms bad and irrecoverable debts being used frequently.

As the business uses the allowance method the journal entry to record the bad debt recovery is done in two steps as follows. There is another view 3000 is to be considered as bad debts recovered. The accounting treatment of.

Currently the company reports 10000000 in debts in the first 0 to 30 days period and 100000 in deficits in the next 31 to 60 days period. This means that the allowance. Accounts receivables are the money owed to the company by the customers.

Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. The concerned debtors account is closed in the books of the firm and at the end of the period the bad debts account is transferred to the debit side of the Profit and Loss Account. It is known as recovery of uncollectible accounts or recovery of bad debts.

Debts usually turn out as bad because of. The credit balance on the account is then transferred to the credit of the statement of profit or loss added to gross profit or included as a negative in the list of. Pass the necessary journal entries and Prepare Revaluation Account Partners Capital Accounts and opening Balance Sheet of the new firm.

As an when they arise. And the remaining portion which is not recovered from the debtors is called bad debt. The accrual accounting system allows such credit sales Credit Sales Credit Sales.

A business had previously written off a bad debt of 2000 using the allowance method for bad debts but has now managed to make a bad debt recovery and has received 900 in part payment of the account. After that the transactions are posted to the Ledger in. In most cases this.

There will be no entry for the promise made by Mohan since it is an event and not a transaction.

Journal Entry For Recovery Of Bad Debts Accountingcapital

Bad Debts Recovered Journal Entry Important 2022

Journal Entries For Bad Debts And Bad Debts Recovered Youtube

Journal Entry For Bad Debts And Bad Debts Recovered Geeksforgeeks

No comments for "Bad Debts Recovered Journal Entry"

Post a Comment